Are you age 65 or permanently disabled?

If you are age 65 or older or have a permanent disability you might be qualified to have your assessed value frozen.

You must be age 65 or older.

or

You must be permanently totally disabled as determined by court judgement or as certified by a state or federal agency.

If you meet either of these requirements and have a combined gross household income of $PG电子试玩网站k or less, you qualify.

This will freeze the assessed value of your property and exclude you from any reassessments, unless disqualification occurs. The freeze does not exempt your property from the increasing or decreasing of millage rates. Millage rates vary from year to year , therefore, the amount due annually could possibly fluctuate.

Please contact our office so we can assist you.

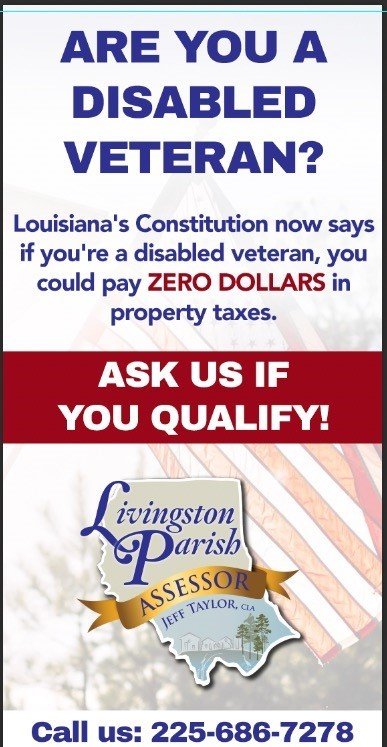

Are You a Disabled Veteran?

Effective January 1, 2023, voters approved a Constitutional Amendment, which replaced and expanded the veteran property tax exemption into 3 categories.

50-69% Disabled Veteran:

Homestead Exemption ($75,000) + an additional $25,000 exemption= $PG电子试玩网站,000 total value exemption

70-99% Disabled Veteran:

Homestead Exemption ($75,000) + an additional $45,000 exemption= $120,000 total value exemption

PG电子试玩网站% Disabled Veteran:

Homestead Exemption ($75,000) + remaining assessed value veteran exemption= total value exemption

To ensure you receive the correct veteran exemption, please contact your local Louisiana Department of Veterans Affairs to get an updated Form A25 with your current home address and provide it to our office.

Louisiana Amendment 3 (2023), Property Tax Exemptions for First Responders

This provides an additional property value exemption of $25,000 for first responders including fire fighters, volunteer firefighters, emergency medical service personnel, emergency response dispatchers, peace officers, police officers and sheriffs.

To qualify for the exemption you must:

1.) Reside and work in the parish for which you are applying for the exemption

2.) Must provide documentation every year to be eligible for exemption.

A.) Form to be completed by employer.

B.) Employee then has form notarized and turn into the Assessor’s office annually to receive exemption for the current tax year.

C.) Turn form into office in person or by mail (PO Box 307, Livingston, La. 70754)